Why Your Job Search Should Never Be Over

Never Limit Yourself- December 24, 2018

- Credit, Education

- Posted by admin

- No comments yet

Did you know that unemployment rates are the lowest they have been in over 50 years, but there is a record 6.6 million open jobs? You may be asking yourself – what does that mean for me? It can mean the difference between thousands of dollars in salary and benefits! A hot job market gives employees the upper hand to negotiate more pay and better benefits. When there are more job openings than available talent, employers fight hard to attract or retain great employees.

You may be working in a great position now but the best time to find a new opportunity isn’t when you’re unemployed – it’s when you’re currently working! Worried you’re going to be the only one moving around? False. The average tenure is now only four years – with younger workers [...]

- December 17, 2018

- Credit

- Posted by admin

- No comments yet

The infamous credit score, we meet again. It always seems like you cannot make any ‘adult’ decisions without proudly displaying a seemingly arbitrary number that is used to judge you. Feeling defeated is common when it comes to figuring out and improving your credit score, but it doesn’t have to be that way. There are plenty of resources available to help you understand your credit score, like us right here at FinaceEvolve, as well as plenty of resources available to help you improve your score.

First and foremost – do you fully understand your credit score and know what the number is? Utilizing a completely free service like Credit Sesame is a great tool you can use to check your credit score every month absolutely free. Especially if you are trying to improve your score, it’s [...]

- December 17, 2018

- Credit

- Posted by admin

- No comments yet

Payday loans versus personal loans; while they are kind of sound the same they are actually quite different. If you’re considering one or the other keep reading as we are going to break down all the “need to know” details like advantages and disadvantages of each as well as how they can affect your credit score.

Payday Loans

This is one situation where it’s pretty much exactly what it sounds like. A payday loan is typically due on or around your next paycheck. It’s an extremely short-term, high-interest loan specifically for small amounts as state regulations generally cap out at $1,000 but can vary by state. Payday loans can be advantageous for emergency items like an unexpected car repair. They are also a good fit for those with poor credit [...]

Rent Payments Reporting Builds Credit

Raise your score up to 50 Points in 15 days!- December 3, 2018

- Credit

- Posted by admin

- No comments yet

Even though more Americans own than rent, paying rent is a monthly action performed by more than 100 million Americans every year. These monthly payments must affect your credit score, right? Surprisingly, the answer is far more nuanced than it would seem.

Credit bureaus didn’t include rent as a positive influence in your score until 2011, and the trend is only gathering steam in the recent past. The fact that it’s gaining popularity is incredible news, especially for people who want to boost their score, fast.

Tools like Rent Reporters have been created to help you rebuild your credit; opening you up to the possibilities of becoming a homeowner, achieving lower interest rates and gaining approval for loans, to name a few. Moreover, this tool can boost your score by an average of [...]

The Importance Of Your Credit Score

What everyone should know about that small 3 digit number that plays such big part of our lives.- November 16, 2018

- Credit

- Posted by admin

- No comments yet

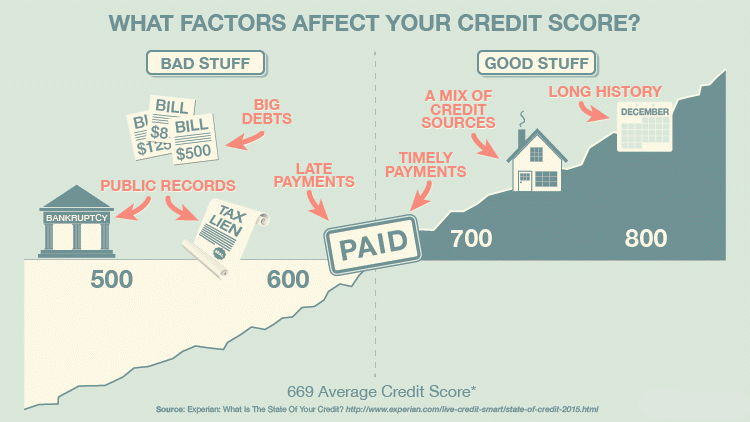

Most of us use credit cards on a daily basis. We understand how they work and do our best to pay the bills on time, but, what most of us don’t truly understand are credit scores.

So, what exactly is a credit score and why is it important? According to data from the Boston Federal Reserve, 3 out of every 4 Americans, or 189 million people, use a credit card. With all of this buying power, unfortunately we’re not equipped with the necessary knowledge to maintain good credit scores.

While many Americans do understand the basics of credit scores, we miss the mark on understanding the nuances that cost us money and affect our credit. For example, did you know that there’s more than one credit score used by lenders to evaluate your overall [...]

The Benefits of Improving Your Credit Score From Poor to Good

Your Path to a Brighter Financial Future- July 17, 2018

- Credit

- Posted by admin

- No comments yet

Credit score means a lot in today’s world. This three-digit number can affect your life and your financial posture, especially when it comes to applying for credit cards or borrowing money for a car loan, home mortgage or even a retail account. Whenever you are applying for any type of a credit, the first thing a lender will check is your credit rating to estimate your future ability to pay. Based on this information, your application will either get approved or denied.

When your credit application gets approved, you will be required to pay a finance charge, or interest, in addition to the borrowed amount. You will also be required to make a minimum payment each month to repay the balance. Bottom line, the amount of money you are allowed to borrow and the amount [...]

5 Main Reasons for Adding Positive Credit Tradelines to Your Credit Report

Give Your Credit Score a Natural Boost- July 10, 2018

- Credit

- Posted by admin

- No comments yet

If you are looking for a solid way to boost your credit rating and get a better deal on your next credit card, mortgage or business loan, take a look at tradelines. Adding tradelines for credit is a process of adding accounts to your credit report in order to enhance your credit rating. Sounds simple, but not all tradelines are made equal.

Try adding a seasoned tradeline, or a line of credit with a low debt-to-credit ratio and a solid history of on-time payments. Once the tradeline hits your credit file, you’ll see an immediate adjustment of your credit score, be it FICO® or Vantage. Most of the lenders use FICO® score which is made up of 40% revolving credit accounts where the credit limit is set by the lender. [...]