- November 13, 2018

- Education

- Posted by admin

- No comments yet

A good college education can undeniably be a strong foundation for building a feasible career. However, compared to most other regular expenses, the costs of obtaining a formal college degree have immensely surged over the years. This has ultimately led to most students applying for loans to further their education. However, there are a few viable options for students to continue their education, while simultaneously reducing their dependence on loans. On that end, grants can be taken as a highly useful means to help students and parents escape the vicious trap of expensive debts in the future.

In basic terms, grants are amounts sponsored by the government or charities to help students fully or partially meet their college fees. Most often, grants are provided in order to help students coming from weak financial or social backgrounds. [...]

Pros and Cons of Buying an Extended Auto Warranty

Is it Worth it?- July 17, 2018

- Auto

- Posted by admin

- No comments yet

Buying a new car is always an exciting but often stressful experience. Most people would rather give up the best things in life than negotiate with a dealer. Not only do you have to negotiate with multiple dealers, finding the best option also requires hours of research and price comparison. So by the time you sign your documents and drive your new car off the lot, buying an extended car warranty would be the least of your concerns. This is very common among car shoppers.

Buying a new car is always an exciting but often stressful experience. Most people would rather give up the best things in life than negotiate with a dealer. Not only do you have to negotiate with multiple dealers, finding the best option also requires hours of research and price comparison. So by the time you sign your documents and drive your new car off the lot, buying an extended car warranty would be the least of your concerns. This is very common among car shoppers.

The purpose of this article is to help you understand how extended car warranty works and if it’s a good investment for you in the long run.

How Does Extended Car Warranty Work?There are two types of warranty: original manufacturer warranty, or OEM, and an aftermarket warranty offered by a [...]

The Benefits of Improving Your Credit Score From Poor to Good

Your Path to a Brighter Financial Future- July 17, 2018

- Credit

- Posted by admin

- No comments yet

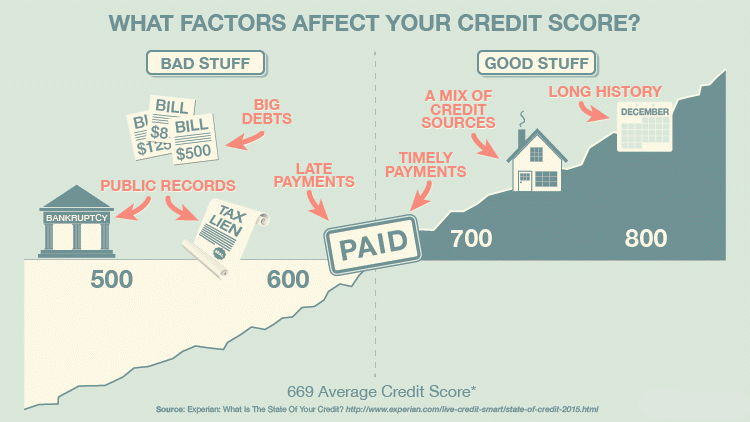

Credit score means a lot in today’s world. This three-digit number can affect your life and your financial posture, especially when it comes to applying for credit cards or borrowing money for a car loan, home mortgage or even a retail account. Whenever you are applying for any type of a credit, the first thing a lender will check is your credit rating to estimate your future ability to pay. Based on this information, your application will either get approved or denied.

When your credit application gets approved, you will be required to pay a finance charge, or interest, in addition to the borrowed amount. You will also be required to make a minimum payment each month to repay the balance. Bottom line, the amount of money you are allowed to borrow and the amount [...]

Used vs New Car:

What Should You Buy?- July 17, 2018

- Auto

- Posted by admin

- No comments yet

Who doesn’t get excited about buying a brand new car? While buying a new car is always alluring, a smart consumer will take a hard look at the cost savings of buying a new vs. used car and consider value and depreciation.

Who doesn’t get excited about buying a brand new car? While buying a new car is always alluring, a smart consumer will take a hard look at the cost savings of buying a new vs. used car and consider value and depreciation.

It is true that on average, a new car will depreciate by as much as 11% the second you drive it off the lot, and it will lose up to 30% of its total value in the first year. By the end of year 3, you can lose up to half of the original price you paid for your brand new car.

Used cars, on the other hand, don’t depreciate as fast. Say you bought a car that’s 3 years old for $15,000. You could still sell it for $10,000 three years later, so it will depreciate [...]

5 Main Reasons for Adding Positive Credit Tradelines to Your Credit Report

Give Your Credit Score a Natural Boost- July 10, 2018

- Credit

- Posted by admin

- No comments yet

If you are looking for a solid way to boost your credit rating and get a better deal on your next credit card, mortgage or business loan, take a look at tradelines. Adding tradelines for credit is a process of adding accounts to your credit report in order to enhance your credit rating. Sounds simple, but not all tradelines are made equal.

Try adding a seasoned tradeline, or a line of credit with a low debt-to-credit ratio and a solid history of on-time payments. Once the tradeline hits your credit file, you’ll see an immediate adjustment of your credit score, be it FICO® or Vantage. Most of the lenders use FICO® score which is made up of 40% revolving credit accounts where the credit limit is set by the lender. [...]

Debt Settlement: Pros and Cons

How Does It Impact Your Credit?- July 10, 2018

- Debt

- Posted by admin

- No comments yet

More often than not, financial struggles lead to poor decision making. If you are seeking to minimize your debt, it’s important to first understand how debt settlement works. Many debt settlement companies offer to reduce your debt by negotiating with your creditors but they don’t really explain how it will impact your credit score in the long run. Let’s evaluate some of the pros and cons of debt settlement to help you determine if this option is right for you.

More often than not, financial struggles lead to poor decision making. If you are seeking to minimize your debt, it’s important to first understand how debt settlement works. Many debt settlement companies offer to reduce your debt by negotiating with your creditors but they don’t really explain how it will impact your credit score in the long run. Let’s evaluate some of the pros and cons of debt settlement to help you determine if this option is right for you.

Debt settlement is the process of offering a large, one-time payment toward an existing debt in return for the forgiveness of the remaining balance. This can be done by hiring a debt settlement company that takes your monthly payments and puts them into a savings account. Once the account [...]