Personal Loan vs. Payday Loan Pro’s and Con’s

- December 17, 2018

- Credit

- Posted by admin

- Leave your thoughts

Payday loans versus personal loans; while they are kind of sound the same they are actually quite different. If you’re considering one or the other keep reading as we are going to break down all the “need to know” details like advantages and disadvantages of each as well as how they can affect your credit score.

Payday Loans

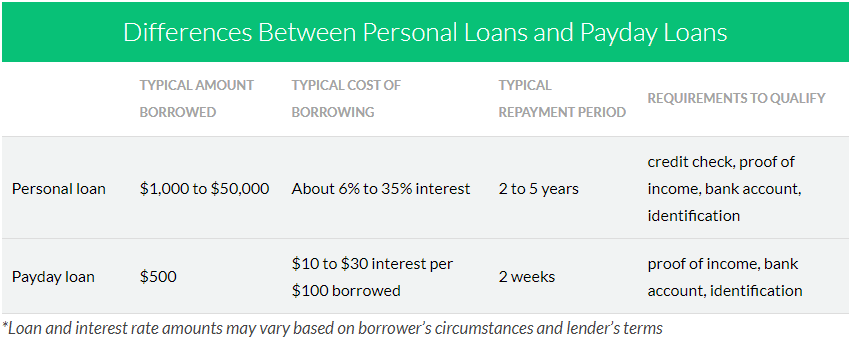

This is one situation where it’s pretty much exactly what it sounds like. A payday loan is typically due on or around your next paycheck. It’s an extremely short-term, high-interest loan specifically for small amounts as state regulations generally cap out at $1,000 but can vary by state. Payday loans can be advantageous for emergency items like an unexpected car repair. They are also a good fit for those with poor credit scores because lenders often don’t look at credit reports. Not only that but simply taking out a payday loan or even many of them is not reported to the credit agencies either so simply getting one won’t affect your credit score whatsoever. So what’s the catch? The high interest and fees on payday loans are what make them get pretty tricky. You can expect anywhere from $10-$30 for every $100 borrowed. If you’re savvy in your APR rates, that would be close to 400%. Yikes. If you’re confident you can pay off the small amount in the time-frame then a payday loan could be a good choice for you, however tread very carefully because if you’re unable to pay back the loan in the short window, heavy fees will be added and can sometimes lead to something called a ‘cycle of debt.

Personal Loan

A personal loan is a considered a short-term loan which has a fixed interest rate and specific repayment period; generally two to five years. You can receive a large amount of money from a personal loan, like Guide to Lenders which can approve you for a personal loan up to $40,000. Personal loans can be secure or meaning they are backed by collateral like your home or car, or unsecured meaning they are not backed by collateral. When getting approval for a personal loan your credit report and score will be considered so it would be a good idea to know what you score is. Credit Sesame is a great way to learn your credit score for absolutely free so you can see what lenders see.

Because the loans are using your credit score, you can expect some variation in your interest rate. Luckily companies like Guide to Lenders are able to offer rates as low as 3.34%, so even if you have less than stellar credit you’ll still see much better rates than payday loans. Guide to Lenders even provides prequalified offers from their top lenders before your credit is checked allowing you to explore the right option for you. Ultimately there are advantages and disadvantages to both payday and personal loans. Be sure to research and get multiple quotes from different lenders to ensure you’re getting the best deal and paying the least amount of fees and interest no matter which loan you choose.