The Importance Of Your Credit Score

What everyone should know about that small 3 digit number that plays such big part of our lives.- November 16, 2018

- Credit

- Posted by admin

- Leave your thoughts

Most of us use credit cards on a daily basis. We understand how they work and do our best to pay the bills on time, but, what most of us don’t truly understand are credit scores.

So, what exactly is a credit score and why is it important? According to data from the Boston Federal Reserve, 3 out of every 4 Americans, or 189 million people, use a credit card. With all of this buying power, unfortunately we’re not equipped with the necessary knowledge to maintain good credit scores.

While many Americans do understand the basics of credit scores, we miss the mark on understanding the nuances that cost us money and affect our credit. For example, did you know that there’s more than one credit score used by lenders to evaluate your overall profile?

We know how complicated this subject can be, and we’re here to simplify it for you. Let’s take a deep dive into the importance of your credit score and the steps you can take to improve it.

What Exactly Is A Credit Score?

When you use a credit card you are buying items with a loan, with the intention of paying that loan back within a specified period of time. Essentially, a credit score is a 3 digit number assessing how likely you are to pay the back the loan you’ve borrowed.

There are three major credit bureaus that make up your FICO (Fair, Isaac and Company) score: Equifax, Experian, and TransUnion.

How Is It Calculated?

Each credit bureau calculates scores differently. However, the core idea is to look into your financial history to estimate your likelihood of paying back a loan.

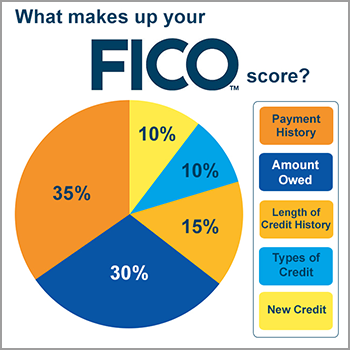

The scores range from 350 (extremely high risk) to 850 (extremely low risk). Specifically, the FICO credit score is an amalgamation of:

- Payment history: This makes up 35% of your score and checks to see if you’ve ever missed payments on your loan(s).

- Current debt: This is 30% of your score and looks at how much you currently owe in credit.

- Length of credit: Making up 15%, it shows how long you’ve been using credit cards/receiving loans and if you’ve paid them back on time.

- New credit: This makes up 10% of your score and checks to see if you’ve applied for other loans in the recent past.

- Types of credit: Finally, 10% is made up of the types of credit you have (i.e. your credit card, credit on your vehicle(s), your home, etc.) The more variety, the better.

There you have it! Paying your loan(s) back on time, every time, is the most important action you can take to establish a good credit score. If you can’t pay it all at once, it’s still important to pay as much as you can each billing cycle to ensure a steady payment history.

Wait, What’s The Difference Between FICO & VantageScore?

If you’ve done your own research, you may have heard of a newer, less popular credit bureau called VantageScore. This bureau was created in 2006 and gives more weight to a person’s payment history and credit utilization when making calculations. In the past, the scores ranged from 501 to 990, deeming anybody under 630 as having poor credit. However, their latest iteration ranges from 300 to 850, matching FICO. This rating system will become more popular over time, so it’s good be aware of.

How Can I Find My Credit Score?

The great news is, there’s many free methods that already exist which help you calculate your score! We partner with credit sesame, a free insight platform that will display your credit score in minutes. These secure platforms gather your basic financial data and use advanced technology to look through your entire credit history. They’re reliable and highly recommended.

Keeping Tabs On My Credit Score

Keeping tabs on your credit score is extremely important! Most Americans know that making payments on time and paying off as much as they can, often, will benefit their score. However, many don’t understand specifically how their score is being calculated and which vendors have access to it.

Typically, scores are calculated and assessed when asking for a loan, renting something (i.e. a car or apartment), applying for jobs and applying for insurance. But, did you know that your local electric company can also take a look into your credit history and raise your rates if you have a poor score? Sounds crazy, right? Unfortunately not.

If you manage your credit poorly, it can come back to haunt you in more ways than you realize. Knowing and regularly checking your credit score gives you more control over these situations. Knowledge is power.

How Do I Make My Score Better?

Ok, so now you have a better idea of what a credit score is and why it’s important. But, you’ve gotten your Credit Sesame report back and your score is poor. How can you fix this?

Firstly, scan your newly acquired credit reports and check for errors. If you notice anything off, you can get it fixed in just a few days via free online platforms. We partner with Lexington Law who are devoted to helping you combat these unfair inaccuracies. This crucial first step can’t be taken alone and we are here to help!

Second, have patience. It may take a bit of time to ramp up your score, but it’s worth the uphill battle. It’s fundamental to start rebuilding your credit as soon as possible. There’s no big, complicated secret as to how to do this; it’s actually quite simple. Use your credit card or apply for a loan, and make your payments on time. That’s it.

Easier than it sounds. But have no fear, we’ve got a few tricks up our sleeves to get you off the ground.

- Confirm that your credit lender is reporting your activity to the main credit bureaus: Ask them if they are, then confirm it by monitoring your monthly score.

- Get a cash secured loan: In this scenario, you’re basically borrowing off of yourself. Say you have $700 in the bank. You ask the bank for a $700 loan and they give it to you, knowing that if you don’t pay it back on time, they can easily take the money you owe straight from your account. It’s a great way to build up your credit score without actually taking out a line of credit. Cool, right?

- Get a secured credit card: It’s essentially the same as a secured cash loan, just in plastic and digital form.

- Have somebody cosign for you: Lenders will allow somebody in your network with good credit to cosign for you. This way, the bank takes little risk and the the heat falls on your cosigner if you can’t pay it back.

- Apply for a personal loan. You’ll make regular monthly payments to the bank, rather than paying the sum of your purchases in a given period. Credit unions like to see steady payments of any type, so this is a useful tool to get you started.

Your credit score affects many essential parts of your life. Understanding how it works and knowing how to increase it over time is key in combating your financial woes or getting out of debt.