Credit Score 101: How and Why Improving Your Score Can Make All The Difference

- December 17, 2018

- Credit

- Posted by admin

- Leave your thoughts

The infamous credit score, we meet again. It always seems like you cannot make any ‘adult’ decisions without proudly displaying a seemingly arbitrary number that is used to judge you. Feeling defeated is common when it comes to figuring out and improving your credit score, but it doesn’t have to be that way. There are plenty of resources available to help you understand your credit score, like us right here at FinaceEvolve, as well as plenty of resources available to help you improve your score.

First and foremost – do you fully understand your credit score and know what the number is? Utilizing a completely free service like Credit Sesame is a great tool you can use to check your credit score every month absolutely free. Especially if you are trying to improve your score, it’s a great idea to monitor it on your own to ensure that it’s continuing to rise.

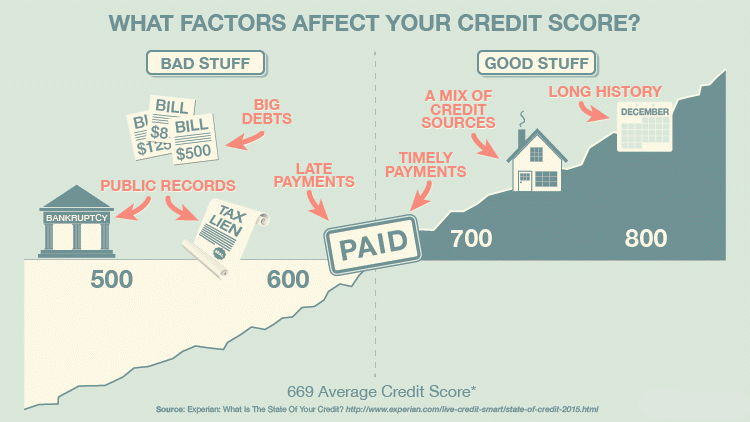

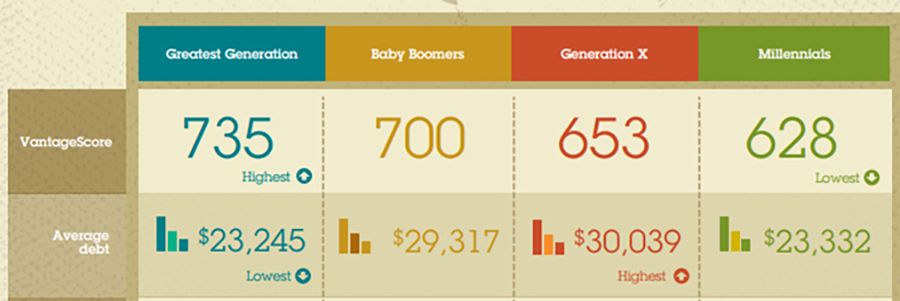

Your credit score is based on your credit reports provided by credit reporting agencies Equifax, Experian, and TransUnion. They use credit scoring models like VantageScore and FICO to give you a score ranging from 300 to 850. Your scores are based on a variety of factors like amount and type of debt, how often you make payments (or more importantly, if you miss payments), and big items like bankruptcy or accounts in collection.

Life can get messy and financial makes can happen to anyone – young or old, but sometimes those mistakes stick with your credit for a long time and are what can really tank your score. While it would be best to avoid mistakes like missed payments, debt collections, bankruptcy or eviction notices, the next best solution is to actively combat these negative marks to help increase your score and see what having an ‘excellent’ score can give you.

How can you improve your score? There are plenty of ways including:

- Personal Loan for Debt Consolidation: Are you still struggling to make monthly on-time payments to your creditors? A personal loan is a great choice to consolidate all debt into one easy payment. You’ll pay off all other accounts on your credit report so it can also increase your score by reducing the number of outstanding accounts in addition to creating a new inquiry that has on-time payments. Our partners at Guide To Lenders can help you compare rates from top loan providers to find you the best deal in minutes.

- A Credit Score Credit Card: Obtaining a simple credit card that you can successfully pay for each month is a great way to help build up your credit. Cards like First Access provide low-limit cards that are reported monthly to all three credit reporting agencies, providing you an account with good standing.

- Rent Reporters: If you’re paying rent each and every month and they are not reporting to the credit bureaus you’re missing out on a great opportunity to build your credit without establishing another line of credit. Rental History Pros will take the last two years of successful rent payments and submit them to the reporting agencies. Most people see a boost of over 40 points after one month!

Lastly, why does this all matter? Outscores often seem like an arbitrary number that is out of your hands but that couldn’t be further from the truth. It matters in a variety of ways including that a higher credit score can mean the world of a difference to your pocketbook in terms of much better financing offers. It can mean the world of a difference between being stuck with a low-budget phone service provider because Verizon or Sprint wouldn’t approve you. It can mean the world of a difference to your family when you purchase your own home and begin to acquire wealth that you’ve never had. What are you waiting for? You can go from a ‘poor’ rating to an ‘excellent’ rating with minimal effort just some strategic thinking – you can do it!