How To Get A College Grant: A Guide To the US Grant System

- November 13, 2018

- Education

- Posted by admin

- Leave your thoughts

A good college education can undeniably be a strong foundation for building a feasible career. However, compared to most other regular expenses, the costs of obtaining a formal college degree have immensely surged over the years. This has ultimately led to most students applying for loans to further their education. However, there are a few viable options for students to continue their education, while simultaneously reducing their dependence on loans. On that end, grants can be taken as a highly useful means to help students and parents escape the vicious trap of expensive debts in the future.

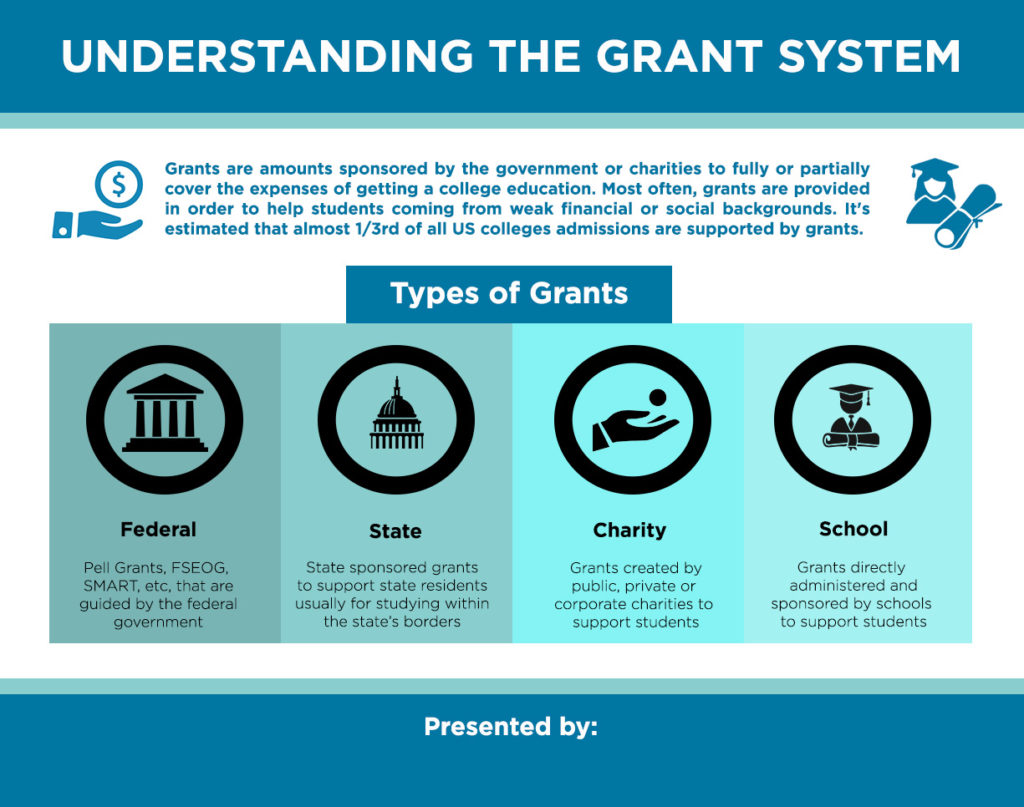

In basic terms, grants are amounts sponsored by the government or charities to help students fully or partially meet their college fees. Most often, grants are provided in order to help students coming from weak financial or social backgrounds. It is estimated that almost one-third of all new enrollments in colleges are supported by grants. In this article we will look at the workings of the grant system and how it can be helpful to students.

How can grants be beneficial?

It won’t be wrong to consider grants as direct financial subsidies meant for college students. There are several government and non-government that provide direct economic grants to students with specific features under certain terms and conditions. Grants can be beneficial for students because of the following reasons:

- Helps in reduction in monthly tuition fees

- Helps in reduction in education loan amount

- It incentives students to put a stronger focus on education and college work

- It improves the students chances of furthering their education

Grants vs loans

Simply speaking, grants make you a beneficiaries, while loans make you a debtors. With all student loan, students are supposed to pay back their loan over the course a specified duration. However, grants are amounts that do not need to be paid back and are considered to be reductions in the overall college fees. Loans are often tied with interests that need to be repaid fully, which will keep increasing as the payment period increases. However, if the terms and conditions of the grants are fulfilled by a student, the grant amount doesn’t come tied with any future debt obligation.

On average every student is provided a grant of $5000. Considering the reduction in the overall loan obligation, this can easily mean a minimum reduction of up to $9,000 over the course of 10 years. Ultimately, the higher the grant, the more beneficial it is for the students. However, unlike loans, not everyone can qualify for government or charity grants. An important thing to remember is that many grant can automatically get converted into loan, if the terms and conditions associated with the grants aren’t fulfilled by the students. A proper research on existing grant, with the help of specialist student support services like Best College Search can increase the likelihood of getting a good grant.

Grant vs scholarships

Grants can be provided to just about any student, with them primarily centered on benefiting students from low-level or middle-level economic backgrounds. On the other hand, scholarships are usually provided to students with specific merit, or from specific social backgrounds. Scholarships are often provided as a combination of lump-sum deductions and direct payment to the students, while grants usually come in the form of direct payments to the colleges and universities through the grant providers,

Types of grants

Grants can be broadly be categorized into four parts, each of which are explained as follows:

Federal Grants

Federal Grants are national-level grants, which are governed under the provisions set directly by the federal government in Washington DC. While there are several grant from the government, the following are the most commonly obtained federal grants:

- Federal Pell Grant

Pell Grant is the most commonly available Federal Grant that is given to students pursuing a bachelor’s degree or a post-baccalaureate teacher certification. This aid is intended for students coming from families with comparatively weaker financial backgrounds. In 2016/17, a total of almost $27 billion was provided under the Pell Grant to over 7 million students. Pell Grant is given to a student who applies for the Free Application for Federal Student Aid (FAFSA) and is determined based on the calculation of the Expected Family Contribution (EFC).

- Federal Supplemental Educational Opportunity Grant (FSEOG)

FSEOG is also provided to students from financially weak families enrolling in undergraduate programs. However, unlike the Pell Grant, it is distributed in a limited quantity on a ‘first-come, first-serve’ basis and is also not supported by all colleges.

- Academic Competitiveness Grant

This grant is meant for college freshmen and sophomores, where the beneficiaries are chosen based on a merit-plus-need based criteria.

- SMART Grant

The Science, Mathematics And Research for Transformation (SMART) Scholarship for Service Program is a special merit-based grant designed to mainly support undergraduate and graduate students pursuing higher education in Science, Technology, Engineering and Mathematics (STEM) disciplines.

- Other Federal Grants

For graduate and post-baccalaureate students looking to pursue a career as a teacher and willing to commit at least four years in a high-need school, the Teacher Education Assistance for College and Higher Education (TEACH) Grant can be a good option. However, like the FSEOG, support for this program is quite limited when compared against the Pell Grant.

There are also special grant for the children of deceased military officers while on duty at Iraq and Afghanistan, which can be applied for if they are considered to be ineligible for the Pell Grant.

State Grants

Most US states have to provide grants and scholarships to its state’s residents and is usually meant to be provided to students who are enrolled in colleges located within the state’s borders. Like Federal Grants, the State Grants are also allocated to students applying for FAFSA. However, each state has its own criteria to determine who gets the grant. Some of these grants are merit-based, while some are intended to benefit students from specific backgrounds. You can check the complete list of state grants by going to the NASFAA portal.

Charity Grants

Many private and public charities provide grants based on specific criteria. There are various grants and scholarship provided by organizations ranging from corporate institutions to churches. The charities have their own specific criteria for selecting the beneficiaries.

School Grants

Some universities and schools have their own grant, independent of government or charity. However, such are also tied to peculiar terms and conditions that suit the requirements of the institutions.

Applying for grants

You can apply for grants by filling the FAFSA before the stated deadline. However, students do need to be aware about the terms and conditions tied with every grant. A proper use of a grant can definitely pave the way for a debt-free before you take your first job, but failure to meet the strict terms and conditions can put you in further debt.

There are some very handy free online resources that students can use to find the right grants. One of the most useful resources that we can suggest is the Best College Search platform. Take adequate time to research and find the right grant that suits your preferences and situation in the platform.

Even if you fail to qualify for Federal or state grants, you can take opportunities provided by private charities and colleges to fund your education. If needed, take direct advice from trusted organizations and agencies like Federal Student Aid and NASFAA. Just remember that applying for grants through proper channels and processes can indeed help any deserving student get grants to further their education.